Porto-based Astrolabium has launched PowerNavigator, a platform designed to help energy-sector companies manage price fluctuations and improve cost control at a time of ongoing volatility in the Iberian energy market.

Founded by Tomás Andrade de Almeida, who has a background in quantitative finance and physics, and Reha Dişçioğlu, a B2B SaaS professional with more than a decade of experience in regulated industries, the startup is incubated at UPTEC, the Science and Technology Park of the University of Porto.

Astrolabium, as reported by UPTEC, aims to give small and medium-sized enterprises access to analytical and risk-management tools that are typically accessible only to larger players.

PowerNavigator is already available in Portugal and Spain and helps companies make better purchasing and hedging decisions without the need for a dedicated risk-management team.

“My background in quantitative finance taught me how powerful these tools can be. Now we are making them accessible to energy companies so they can plan ahead and protect their margins,” Almeida was quoted as saying.

According to Portugal’s energy regulator ERSE, spot market volatility in both Portugal and Spain rose sharply again in 2024.

Its report shows that Portugal’s spot market volatility reached approximately 72%, meaning day-ahead prices fluctuated between about €18/MWh and €109/MWh over the year. Spain followed a similar pattern, with volatility levels also exceeding 70%.

ERSE notes that the rise in volatility between 2023 and 2024 was influenced by factors such as hydrological conditions, the impact of solar production on the MIBEL market – the joint Iberian electricity market – and changes in natural gas and CO₂ emission costs.

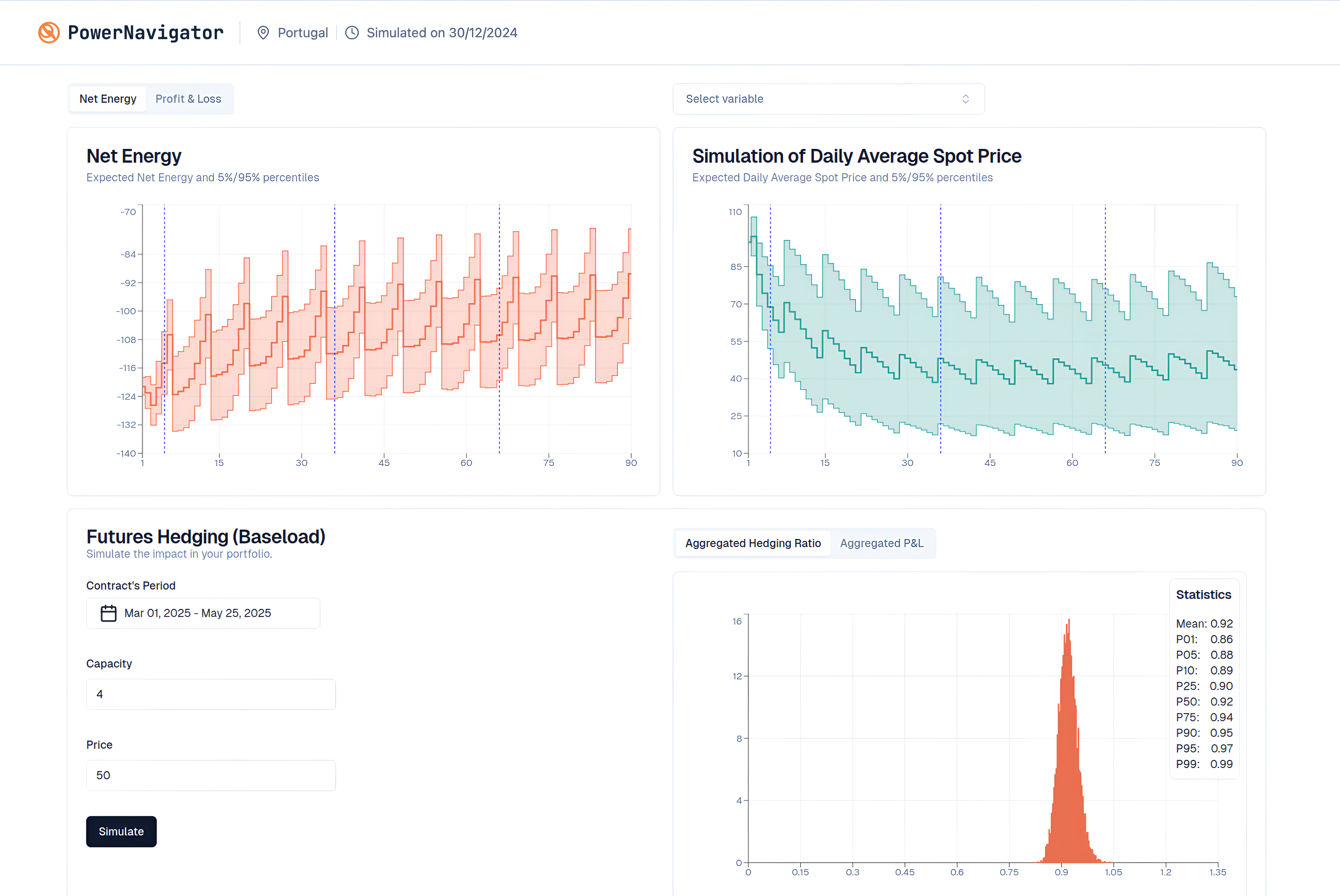

PowerNavigator uses more than a decade of historical market data, combined with weather forecasts, to simulate 10,000 possible price scenarios.

The platform shows the full range of potential prices and the probability of each one, allowing companies to understand the likelihood of different outcomes.

In one example, PowerNavigator may indicate a 70% probability that prices will be between €60 and €80/MWh, a 20% probability of prices exceeding €100/MWh, and a 5% probability of prices rising above €150/MWh.

By presenting these distributions and identifying favorable moments to buy, sell, or hedge, the platform aims to improve the quality of available information and help companies decide the best times to purchase energy.

Featured image: Co-founders Tomás Lobão de Almeida (left) and Reha Dişçioğlu lead Astrolabium’s vision to bring advanced forecasting and risk-management tools to energy-sector companies. (Photo courtesy of Astrolabium/via UPTEC)