SmartRoadsAI, a Portuguese startup using standard smartphones to monitor road conditions with artificial intelligence, aims to help cities shift from reactive repairs to continuous, data-driven predictive maintenance, reducing infrastructure costs, emissions, and road safety risks.

“Roads are one of the largest public assets cities manage, but condition data is still scarce, expensive, and outdated,” Pedro Marcelino, co-founder and CTO of SmartRoadsAI, told Portugal Startup News in an interview.

According to him, the company’s goal is to make road-condition monitoring proactive by default, rather than driven mainly by complaints or visible failure.

The idea behind SmartRoadsAI originated in Marcelino’s PhD research on machine learning for road-transport infrastructure at Instituto Superior Técnico, where he explored how standard smartphones in municipal fleets could act as a passive sensing layer for continuous road monitoring, without dedicated inspection vehicles, additional staff time, or new hardware expenditure.

The company, co-founded by Marcelino and Thaís Araujo, is now in the customer-validation stage, active in Portugal and Brazil, and focused on converting its pilots into recurring subscription contracts and scalable rollouts.

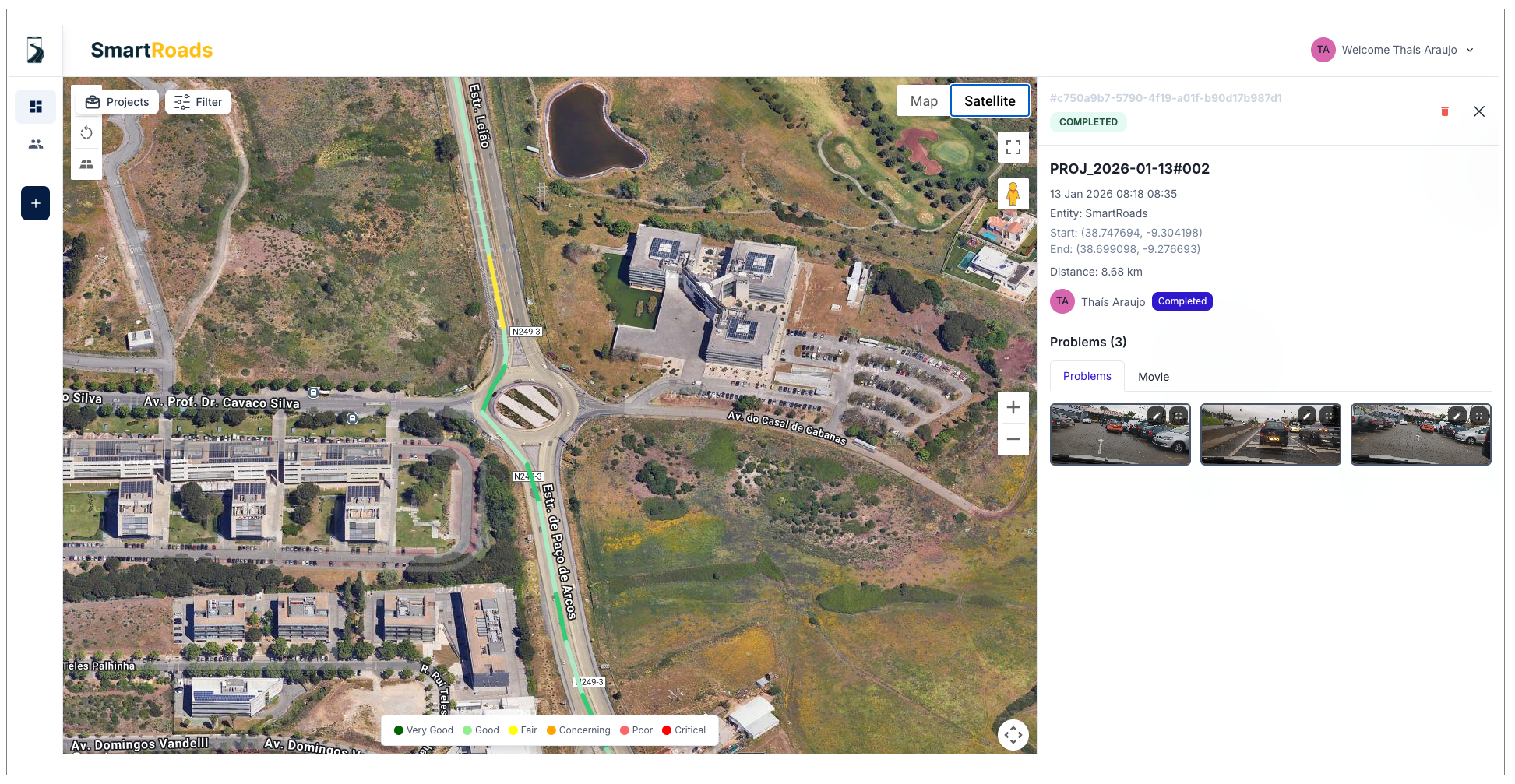

SmartRoadsAI turns smartphones already used in municipal vehicle fleets into road sensors, collecting vibration and GPS data during normal driving and applying machine-learning models to detect potholes, sharp impacts, and continuous pavement degradation along road segments.

When video is used, computer vision helps classify issues such as crack patterns, surface breakup, and pothole characteristics.

The results are delivered through a no-code web dashboard that provides clear reports and integrates with existing municipal systems.

The company estimates its system could contribute to 30% cost reduction, 40% lower CO₂ emissions, and 60% lower accident risk, alongside higher citizen satisfaction as defects are addressed earlier.

In 2025, SmartRoadsAI won first place in the Smart Cities and Mobility cohort of EIT Jumpstarter, providing EU-level validation of its approach.

Marcelino said the company is building the platform in close collaboration with public authorities and encouraged municipalities and operators to get in touch to explore pilot projects and partnerships.

Read the full interview to learn more about how SmartRoadsAI’s sensing system works in practice, early pilot use cases, municipal feedback, pricing, funding plans, and the company’s priorities for 2026.

1- What originally inspired you to start SmartRoadsAI?

SmartRoadsAI started directly from my PhD work on machine learning for road-transport infrastructure. During that research, I saw a simple leverage point: standard smartphones already riding in municipal fleets can act as a passive sensing layer, capturing road-condition signals continuously, without dedicated inspection vehicles, extra staff time, or new hardware capex.

That “no-extra-effort data” concept matters because roads underpin everyday mobility and the local economy. If you detect degradation earlier and more objectively, cities can intervene sooner, improve safety, and avoid costly reactive repairs.

2- In practical terms, what changes for a city once it moves from reactive to predictive road maintenance?

Moving from reactive to predictive road maintenance is like preventive medicine: you detect early signs of deterioration and treat them before they become major failures that are far more expensive and disruptive to fix.

Several things change for a city. First, cost: early interventions are smaller and cheaper (fewer crews, less equipment, shorter closures). By acting before defects propagate, cities avoid costly resurfacing or reconstruction.

Second, environmental impact: predictive maintenance enables lighter, less invasive treatments. For example, sealing cracks is far less resource-intensive than milling and resurfacing with heavy machinery.

Third, safety: keeping roads in better condition reduces hazardous defects and lowers accident risk, ultimately saving lives.

3- How does SmartRoadsAI use smartphones to reliably detect potholes and road degradation without dedicated hardware?

SmartRoadsAI relies on sensors and cameras that already exist in standard smartphones, so cities don’t need dedicated inspection hardware. We collect two complementary data streams: inertial/vibration signals (from accelerometer/gyroscope) and video (from the camera).

On the vibration side, we use machine learning to learn the road “signature” from the inertial patterns. This produces (1) continuous indicators of overall pavement condition along a segment and (2) event-based detections of anomalies such as potholes or sharp impacts.

On the video side, we use computer vision to validate and classify what the vibration layer flags, adding detail (e.g., crack patterns, surface breakup, pothole characteristics).

In short: vibration provides scalable, always-on condition sensing; video provides precise identification and richer diagnostics – using hardware municipalities already carry in their fleets.

4- What types of road issues are most commonly missed by traditional inspections but flagged by your system?

Before comparing methods, it’s important to be blunt: many municipalities would like to run systematic inspections, but in practice they can’t.

Covering thousands of kilometers with dedicated surveys is expensive, operationally heavy, and often requires specialized equipment and trained staff that cities don’t have. As a result, the default becomes sporadic checks and citizen complaints.

Against that baseline, the most commonly missed issues are (1) early-stage deterioration that doesn’t trigger complaints and isn’t easy to score consistently by eye, and (2) objective, network-wide measures of road condition – ride quality/roughness (e.g., IRI-like indicators) – which typically require specialized equipment such as profilometers.

Traditional inspections are good at spotting obvious defects like potholes, but they don’t provide consistent, scalable condition metrics.

SmartRoadsAI covers both: it flags discrete anomalies (potholes/impacts) and tracks continuous degradation along segments, producing a city-scale map of where the network is good, where it’s degrading, and where it’s degrading faster.

Because data collection happens daily as vehicles move, municipalities get near real-time, continually updated prioritization, at a cost and operational footprint they can sustain.

5- What were your main milestones in 2025, and at what stage is SmartRoadsAI today?

In 2025, the key milestones were (1) external validation and visibility, and (2) proving the solution works in real municipal operations.

On validation, we won EIT Jumpstarter 2025 (1st place, Smart Cities and Mobility cohort) and the BGI’s Urban Mobility Startup Creation Program. That gave EU-level credibility and confirmed the problem/solution fit resonates beyond our local network.

On execution, we moved from concept to an MVP that is running end-to-end and launched municipal pilots in the Algarve.

Today, SmartRoadsAI is in the customer-validation stage: the core sensing and platform are working in the field, pilots are active, and the focus is calibrating accuracy, workflows, and the product experience so pilots convert into paid subscriptions and scalable rollouts.

6- What did winning EIT Jumpstarter last year in the Smart Cities and Mobility cohort validate for you and the company?

Winning EIT Jumpstarter validated, first of all, that the idea is not just a “research hallucination.” When a concept comes out of a PhD, you can be deeply convinced technically and still be wrong on market reality.

The Jumpstarter process put SmartRoadsAI through repeated, independent filters – different experts, different countries, different perspectives – over many months, and it held up.

It also validated two concrete things for the company: (1) the problem is widely recognized and painful for municipalities (maintenance is still largely reactive because systematic monitoring is hard to sustain), and (2) we can translate deep tech into a deployable product story that stakeholders understand and want to test.

7- How are municipalities responding to SmartRoadsAI so far? Are they generally open to this approach, or do you face resistance? If so, what are their main concerns, and how are you addressing them?

Municipalities are generally very open to the approach once we get in the room with the right team as it addresses a real operational need and is easy to adopt: there’s no dedicated hardware to buy, no specialized staff to hire, and deployment is lightweight.

In practice, we can go from a first meeting to collecting data within minutes, which lowers the barrier to “let’s try it.”

The main initial concerns are practical. First, credibility: “Does it really work on our roads?” We address that with short pilots, clear before/after comparisons, and ground-truth checks on a sample of locations.

Second, operational and technical burden: “Do we need specific equipment, and will this overload our team?” We address that with a very simple smartphone app that collects data passively and can run in the background.

Setup is minimal: install the app, tap one button to start an inspection, tap another to stop, and the data syncs automatically to the dashboard with no manual processing.

The biggest friction is usually not technical resistance but access: municipal decision-making is structured and filtered, so reaching the right stakeholders can take time. We handle that through partnerships, warm introductions, and a pilot-first approach that makes internal approval easier.

8- Can you share any concrete data points from pilots or early municipal partners that demonstrate impact, such as cost savings, safety improvements, or operational efficiency?

Yes, I can share two examples from early pilots.

One municipality used SmartRoadsAI to quickly characterize road conditions and support a repaving/funding request. Instead of mobilizing teams for ad-hoc field notes and subjective ratings – as they were trying to do without success – they used our outputs (objective condition measures plus visual evidence) to document needs and prioritize segments much faster and cheaper.

A second example shows the value of near real-time updates. In a review meeting, a stakeholder said a location couldn’t have a pothole because they had been there the week before. Our data showed it had appeared after that and was detected on a vehicle pass from the previous day. That’s the practical difference: the network view stays current without sending teams out every time.

9- What is your pricing strategy, and how does it compare to traditional road inspection costs?

We use a subscription model with an annual fee. A municipality pays once for the year and gets access to the SmartRoadsAI app and dashboard for its road network, with a simple deployment model (no dedicated hardware, no specialized teams).

To make the comparison tangible, consider a typical small/medium municipality in Portugal, with roughly a 1,500 km road network.

If you want an updated picture of the entire network every month, every week, or every day, the cost of traditional visual/manual inspections escalates very quickly because you’re effectively paying to mobilize people and vehicles each time.

In this context, compared with SmartRoadsAI, manual inspections are roughly 14-18x more expensive for monthly coverage, 63-78x more expensive for weekly coverage, and 440-550x more expensive for daily coverage.

With SmartRoadsAI, the economics don’t scale that way: you pay the same annual subscription whether you want monthly, weekly, or daily coverage, because the data is collected passively as municipal vehicles drive their normal routes.

10- Which markets are you currently active in, and what makes a city a good fit for SmartRoadsAI?

Right now we’re active in Portugal and Brazil.

A city is a good fit when it matches the “early evangelist” profile: it is actively seeking a better way to monitor its road network, has already attempted an internal or external solution that fell short, and is open to piloting a product that is still evolving.

In practice, the best partners have a clear internal champion, fast access to decision-makers, and the willingness to co-create: give feedback, align on success metrics, and iterate the workflow with us so the product fits their reality.

11- Are you pursuing European and global expansion?

At the moment we’re focused on Portugal and Brazil, not broad global expansion.

The priority now is to validate a repeatable, scalable model (i.e., product, delivery, and sales) before we try to expand widely. Portugal and Brazil are the right focus for this stage because that’s where we have the strongest networks and easiest access to municipal partners, and the shared language reduces friction when we need close collaboration and fast iteration with teams on the ground.

Once we have consistent pilot-to-contract conversion and a proven rollout playbook, we’ll pursue European expansion first and then broader international growth.

12- What are your main priorities for SmartRoadsAI in 2026?

In 2026, our main priority is customer validation: proving, with real municipal partners, that SmartRoadsAI reliably solves a high-value problem and fits their day-to-day workflows.

Concretely, that means tightening the product around what municipalities actually need – accuracy calibration, clear and actionable outputs, and a frictionless user experience from “install and run” to “prioritize and intervene.”

The goal is to convert pilots into recurring contracts and establish a repeatable deployment and sales playbook.

Only after that foundation is solid do we move from the “start” phase into scaling.

13- How do you plan to fund the next phase of SmartRoadsAI’s growth?

We’re currently bootstrapped, and we plan to keep it that way as long as it remains compatible with our growth pace and product roadmap.

We believe that the next phase will be funded through two main channels: revenue from municipal subscriptions as pilots convert into paid rollouts, and selective non-dilutive funding grants and innovation programs that fit our development strategy and accelerate validation and deployment without changing the core plan.

14- Are there any additional comments you would like to make?

Two closing points.

First, roads are one of the largest public assets cities manage, but condition data is still scarce, expensive, and outdated. Our goal with SmartRoadsAI is to make road-condition monitoring continuous and affordable, so maintenance becomes proactive by default, not only after complaints or visible failures.

Second, we’re building this with municipalities, not just for them. If you’re a municipality, operator, or partner working on road maintenance and you want to explore a pilot or collaboration, reach out to us.

Featured image: Pedro Marcelino, co-founder and CTO of SmartRoadsAI (Photo source: SmartRoadsAI)